Civil Service Pensions Scheme (CSPS) – Capita update

Capita provides an update for Civil Service Pensions Scheme (CSPS) members on service delivery.

Read moreSummary

Jon Lewis, Chief Executive Officer, said:

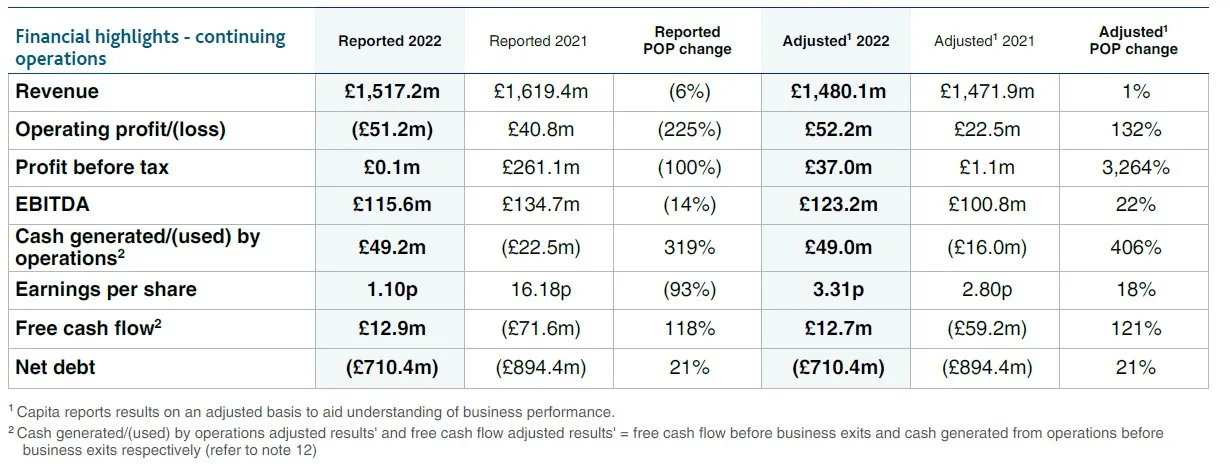

"I am pleased with the progress we have continued to make across Capita so far this year. “Our performance has been in line with our expectations. We have increased adjusted revenue, profit and free cash flow; and further reduced debt and strengthened the balance sheet. “Operationally, we have remained strong, continuing to deliver successfully for our many clients in both the public and private sectors.

“As our reputation for delivery and digital transformation services increases, we have secured a series of important contract wins and renewals, as well as growing the amount of work won with new clients.

“We are well positioned for growth in the second half of the year and beyond; and our full-year commitments remain on track.

“All of this has been achieved against the ongoing backdrop of Covid-19 and increasing economic challenges; and I would like to thank all our colleagues for their continued hard work, commitment and professionalism."

Investor presentation:

A presentation for institutional investors and analysts hosted by Jon Lewis, CEO and Tim Weller, CFO, will be held at 09:00am UK time, Friday 5 August 2022. This will be held at Capita offices at 65 Gresham Street, London EC2V 7NQ. A live audio webcast will also be available (www.capita.com/investors) and will subsequently be available on demand. The presentation slides will be published on our website at 07:00am and a full transcript will be available the next working day.

Webcast link: https://webcast.openbriefing.com/capita0822/

Stuart Morgan, Investor Relations Director: T +44 (0) 7989 665 484

Capita press office: T +44 (0) 20 7654 2399

Capita provides an update for Civil Service Pensions Scheme (CSPS) members on service delivery.

Read more

Capita has been awarded a 4 year contract by Kent County Council (KCC) to provide contact centre services supporting 1.6 million residents.

Read more

Share