Insights & News page

Navigating complexity with confidence

We help financial services organisations thrive in a fast-moving, highly regulated landscape - delivering seamless customer experiences and operational excellence.

With 90% of European firms already integrating AI into their operations and 72% planning increased investment in generative AI, the sector is rapidly evolving. AI-driven personalisation and predictive analytics are transforming customer engagement, but regulatory compliance remains a challenge, with only 11% of businesses fully prepared. Our structured frameworks ensure transparency, trust, and alignment with regulatory demands - empowering financial institutions to innovate responsibly.

Areas covered:

- Retail and commercial banking

- Insurance

- FinTech

- Mortage origination software

- Wealth Management

Why choose us?

Scalable and flexible to ensure agile customer service provision.

Deep industry expertise.

Skilled, multilingual workforce, experienced in managing vulnerable customers.

Client case study

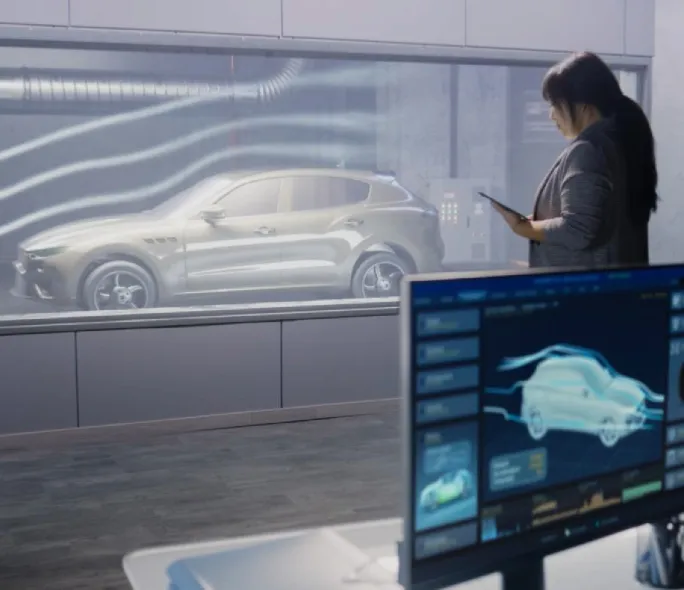

Motor finance: setting the pace for your automotive sales experience

As consumer expectations in the automotive industry shift toward personalised and accessible digital experiences, a leading brand sought to redefine customer engagement.

We extracted critical customer insights that informed the development of an innovative ‘Live Tour’ solution, enabling live video customer interactions. This significantly increased showroom visits, test drive bookings, and conversion rates.

By sourcing the right technological framework and assembling a team of trained product hosts, we helped create a seamless and engaging purchasing experience, strengthening the brand’s sales network and customer satisfaction.

We’re transforming the delivery of services for our clients with our groundbreaking AI solutions, delivered in collaboration with our hyperscaler partnerships:

CapitaContact: A comprehensive AI-powered offering designed to transform customer experience and contact centre performance, supporting quick and agile flexibility during peak seasons.

AgentSuite: A Gen AI tool designed to improve customer service by streamlining and enriching the experience for clients, their customers, and agents using real-time tips, product information, and emotional insights.

Find out more about our hyperscaler partnerships

A faster, smarter, seamless mortgage origination platform

Omiga Digital is our trusted, scalable, highly automated mortgage origination platform, built to provide brokers and customers with a seamless origination journey.